does texas have a death tax

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania.

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

There is a 40 percent federal tax.

. Does Texas Have Its Own Estate Tax. If your gross estate is over 114 million you. Only 12 states plus the District.

If you die with a gross estate under 114 million in 2019 no estate tax is due. Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to. This means that if a person passes away on June 1 2009 that persons final income tax return will cover only the period from January 1.

A transfer on death deed has no legal effect during the owners life so state ad valorem property tax. Federal estate taxes do not apply to. There is a 40 percent federal tax however on estates over.

At 183 compared that to the national average which currently. A persons death terminates his or her taxable year. The federal estate tax disappears in 2010.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. It only applies to. What are the state and federal tax consequences of a Texas TODD.

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased. It is a transfer tax imposed on the wealthy at death.

Therefore the estate will have a death tax liability of 37 x 740000 155800 429600. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. Texas does not have an estate tax either.

Instead of collecting income taxes texas relies on high sales and use taxes. There is a Federal estate tax that applies to estates worth more than 117 million. Death Taxes in Texas.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. At 183 compared that to the national average which currently stands at 108. Live Call Answering 247.

Inheritance Tax Laws in Texas. Does every state impose a death tax. Call or Text 817 841-9906.

Texas has no income tax and it doesnt tax estates either. Texas is one of the states that do not collect estate taxes. Prior to September 15 2015 the tax was tied to the.

However Texas does have the sixth highest property tax rate in in the US. Does Texas Have A Death Tax. No not every state imposes a death tax.

Call or Text 817 841-9906. However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million.

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get What We Pay For Candysdirt Com

Talking Taxes Estate Tax Texas Agriculture Law

Blog Pakis Giotes Page Burleson A Professional Corporation

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

2018 Estate Tax Changes Texas Agriculture Law

The Estate Tax And Real Estate Eye On Housing

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Republicans Unveil Tax Plan With Death Tax Repeal Texas Farm Bureau

Death Tax Instant Equipment Expensing In Final Tax Reform Plan Texas Farm Bureau

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

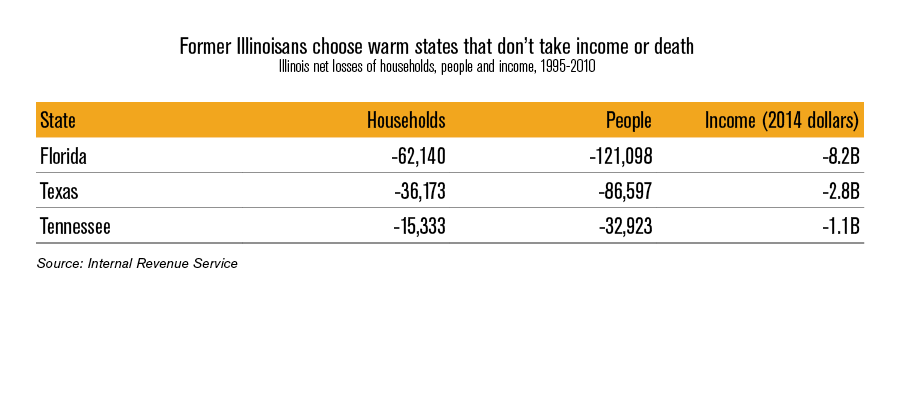

Illinois Should Repeal The Death Tax

Death Tax In Texas Estate Inheritance Tax Law In Tx

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Mckinney Estate Tax Planning Attorney Luce Evans Law

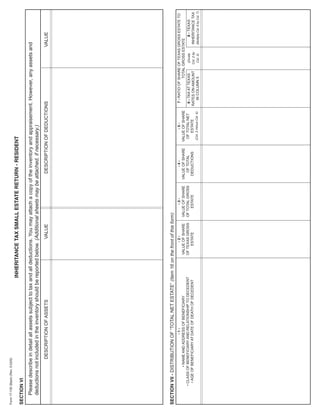

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

Death Tax In Texas Estate Inheritance Tax Law In Tx

Top Ten Reasons The U S House Will Kill The Death Tax

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021